The "Casino" Market: Why the Fed Held an Emergency Meeting While Insiders Are Selling

- Nico DE BONY

.jpg/v1/fill/w_320,h_320/file.jpg)

- Nov 17, 2025

- 7 min read

We are at one of the most confusing and critical moments in recent market history.

On the surface, the stock market is near all-time highs. But underneath, the entire foundation is showing signs of a severe breakdown. US households now have 52% of their financial assets in stocks, a level even higher than the 2000 dot-com bubble. Retail investors are "all-in" and using extreme leverage.

But at the exact same time, corporate insiders are selling their own stock at the fastest rate since 2000.

What do they know that the public doesn't?

It looks like we are in a casino, not a market. This isn't a "soft landing." This is a massive divergence, and the "real economy" is in a slow-bleed recession.

This week is critical. We have the FOMC minutes, the start of a post-shutdown data dump, and Nvidia's earnings.

Before those events hit, here are the key signals you need to know.

1. The AI Bubble: "Insiders Are Selling the Party"

The market is being held up by one single narrative: the AI Bubble. But this bubble is showing serious cracks, and the charts are showing massive similarities to the 1929 bubble.

Michael Burry Exposes the "Fraud": Michael Burry, the investor from "The Big Short," is not just buying puts; he's closing his fund. His analysis points to what he calls an "AI CAPEX fraud". He is exposing that many big tech companies are artificially inflating their profits by manipulating their accounting, specifically by depreciating (or amortizing) their expensive GPUs over 5-6 years, when everyone knows they are obsolete in 2-3 years. This simple accounting trick can make profits look 20-30% higher than they really are.

Why is Burry closing his fund? My take is that he's refusing to play a game whose rules are incompatible with sanity. He likely wants to avoid the pain of managing client expectations and answering questions, just as he did for two years before the 2008 crash. He is freeing himself to be right without the pressure of clients who might panic and pull their money at the wrong time.

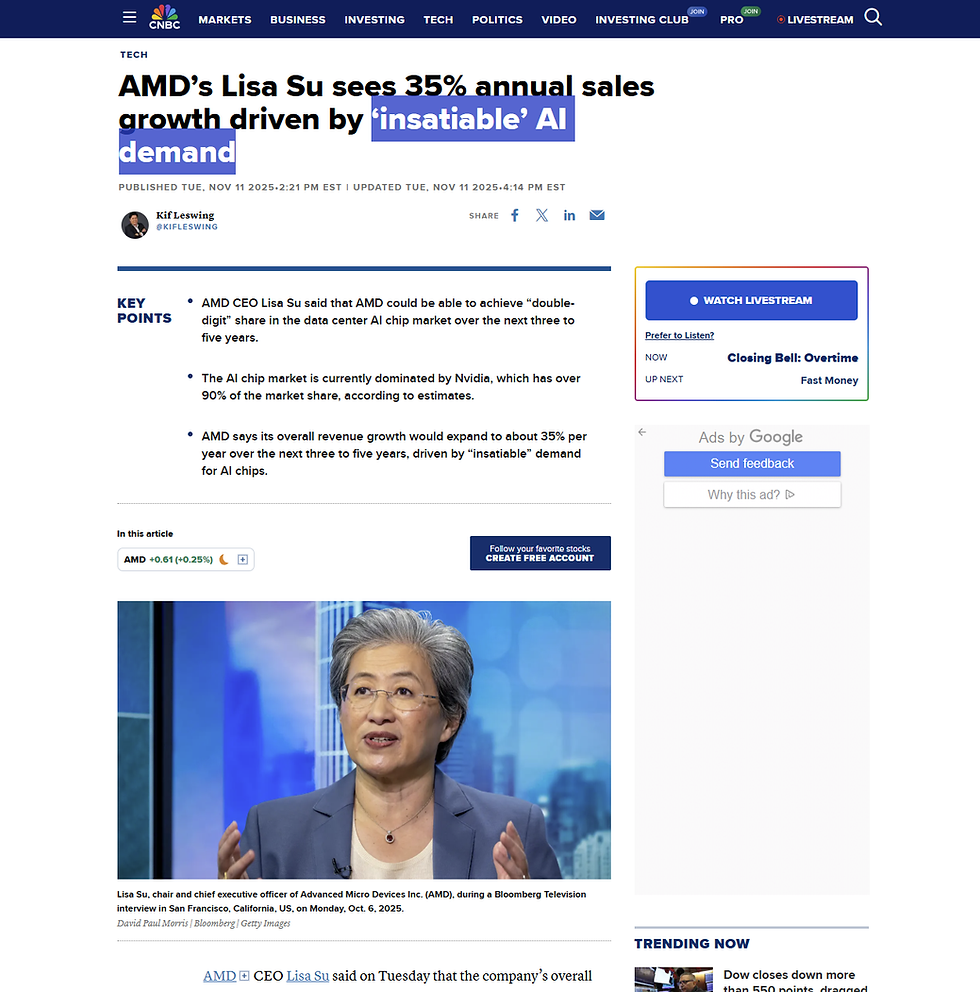

The Narrative is Cracking: Beyond the accounting, the narrative is weakening. We're seeing reports of empty, unpowered warehouses being called "data centers". TSMC, the chipmaker, just posted its slowest growth in 18 months. Even AMD's CEO, while projecting strong growth, called AI spending "the right gamble", a strange choice of words for a sure thing.

The Math Doesn't Work: The AI boom is now funded by debt, not free cash flow. This is causing Credit Default Swaps (CDS) for companies like Oracle to spike.

The first dominoes are falling. Oracle (ORCL) is already down 30% from its recent high. CoreWeave (CRWV) saw massive insider selling right before their weak guidance tanked the stock. This puts immense pressure on Nvidia's earnings this week.

2. The Stock Market's "Exhaustion" Signal

This brings us to the most bearish technical signal of all, and it's the one most people are getting wrong.

94% of S&P 500 companies are now out of the corporate stock buyback blackout window, meaning they are allowed to buy back their own stock.

This means the single biggest, price-insensitive buyer in the market is fully active. And yet, despite this record-breaking buyback activity, the stock market is weak and struggling to go up. The buyers are running out of steam.

This weakness is hidden by the major indices. We have terrible "market breadth."

The "real economy" stocks (an equal-weight index) are down -39% since 2022, while the tech/AI-heavy S&P 500 is at all-time highs.

When priced in gold (a real measure of value), the S&P 500 is actually down 27%.

The Hindenburg Omen, a technical signal that warns of a crash, has been triggered 8 times.

We are seeing chart patterns that look eerily similar to the 1987 and 2008 tops.

This is a "Mega-Divergence": Wall Street's euphoria versus Main Street's "Extreme Fear" sentiment.

3. The Real Economy: "Slow-Bleed" Recession

While the "casino" is open, the real economy is in a clear downturn. This isn't a prediction; the data is here.

The Consumer is Tapped Out: Searches for "second job" have just hit an all-time high. At the same time, 401(k) "hardship withdrawals" are also at an all-time high. This isn't strength; it's desperation.

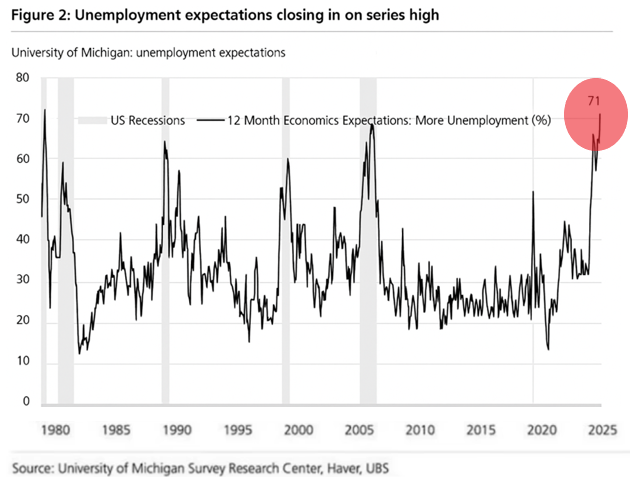

The Labor Market is Collapsing: The weekly ADP report just posted its first negative reading. Consumer unemployment expectations are the worst in 45 years.

The Physical Economy Has Stalled: The Cass Freight Index, which tracks the actual goods being shipped across North America, has plunged back to 2009 and 2020 recession-level lows. Goods are not moving.

Businesses & Consumers are Defaulting: The majority of small firms in the NFIB Small Business Survey reported lower sales, marking the 41st consecutive negative monthly reading. Delinquencies on auto loans and credit cards are rising rapidly and vertically.

Global Weakness: This isn't just a US problem. The UK just posted negative month-over-month GDP. In Canada, mortgage defaults have hit a 5-year high.

4. The Hidden Crisis: The Fed's Emergency Meeting

This might be the most important signal of the weekend, and it happened behind closed doors.

The Federal Reserve held an emergency weekend meeting with Wall Street banks. The reason? Severe, systemic strains in the credit and repo markets.

This isn't just a minor plumbing issue. This is a solvency crisis (bad debt), not just a liquidity crisis (no cash). We are getting reports that banks with cash would rather sit on it than lend it to other banks at any rate. This is a complete breakdown of trust in the system.

We are seeing a direct echo of 2007:

In 2007, two "high-grade" (supposedly safe) Bear Stearns funds blew up. They were the "canary in the coal mine."

In the last few weeks, in addition to the increasing number of bankruptcies, we had two "high-grade" private credit funds blow up (UBS funds).

These are the "cockroaches" signaling the system is failing. This confirms the Fed's new role. Before 2008, the Fed was the "lender of last resort." Today, they are the "lender of only resort."

As Jerome Powell himself said in 2021: "In a stress scenario today, the Federal Reserve is the only entity with the balance sheet to absorb the shock."

The free market's ability to absorb this has been broken. We are now, for the first time, about to see what happens when a bubble managed by the Fed—which is always late to react—finally bursts.

5. Bitcoin Update: Extreme Fear vs. Institutional Accumulation

Finally, let's talk about Bitcoin. The price action looks weak, and there is a lot of fear in the market. But what's fascinating is that the sentiment signals we're seeing aren't just pointing to a local bottom—they are the kind of signals you see at a major bear market bottom.

Now, technically speaking, the chart doesn't look good. We just had our first weekly close below the critical $95K support level.

As you can see on this chart, the candle closed at $92,929 (the white line). But for a technical breakdown to be confirmed, we need a second weekly candle to close below that level.

This means the bull market is not technically dead yet. This coming Sunday, November 23rd, is now the "make-or-break" moment. If we close above $92,929, the breakdown is a fake-out and the bull run is still on.

Until then, the price could drop lower to test key support. The next major levels I'm watching are $90,000 (a strong psychological number) and, more importantly, $88,500. That level is the "Active Investor Realized Price" from Glassnode—basically, the average cost basis for all active coins. This has been a critical support level in past cycles.

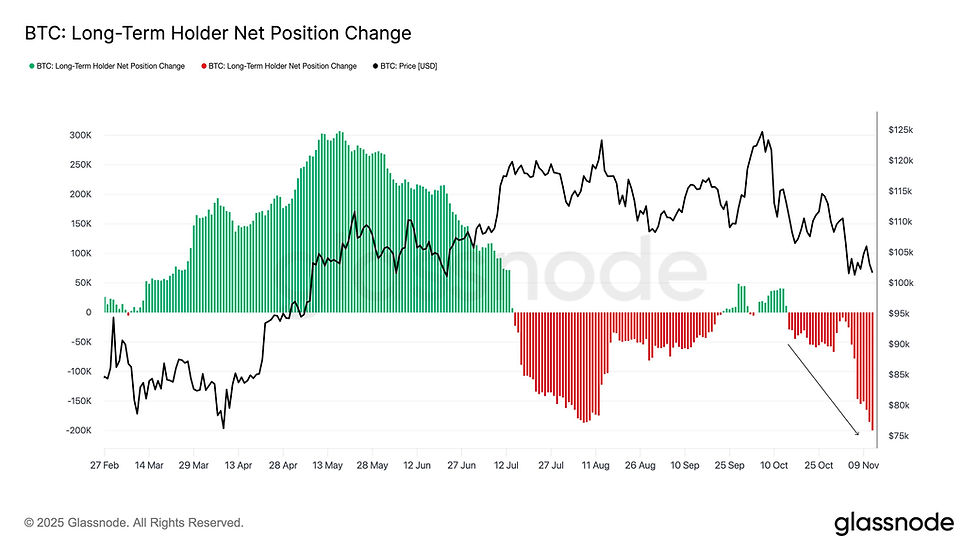

But here's where the story gets disconnected. While the price looks weak, the on-chain data is pointing to a bottom.

Capitulation: We are seeing a full-scale capitulation from Short-Term Holders (STH), which typically happens at a bottom.

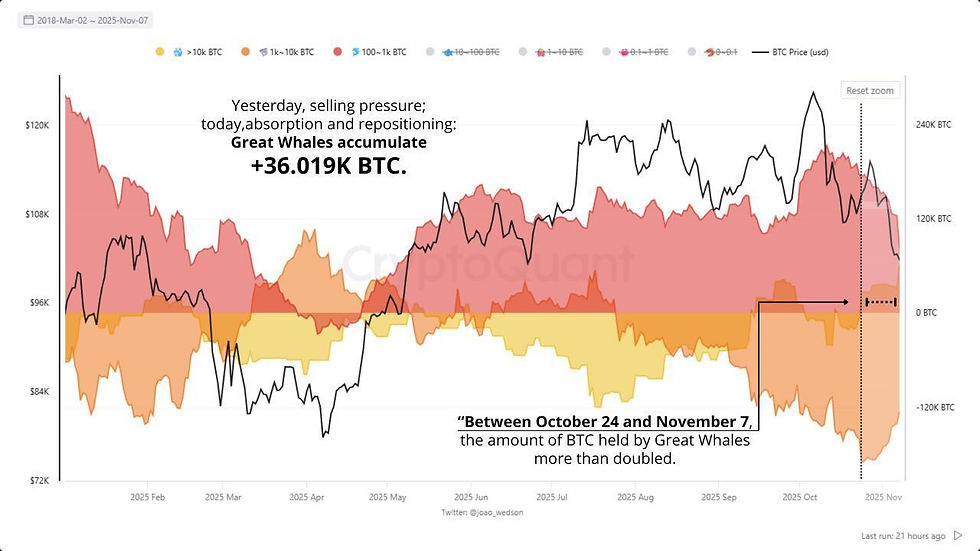

The Great Transfer: It's "kinda different this time" because the main dynamic has changed. It's no longer just retail. We are seeing a massive transfer where some Long-Term Holders (LTHs) and retail investors are selling—many panicked by the 4-year cycle narrative—and a new class of massive institutional buyers is quietly absorbing all that supply.

Stablecoins are Ready: The supply of stablecoins on exchanges is increasing rapidly. This is "dry powder" waiting to be deployed, often right before a major price increase.

This isn't just theory. The skeptics are finally folding. I'm not just talking about pension funds; even central banks are now being advised to buy Bitcoin. The Czech National Bank just did.

And finally, let's look at sentiment. This is the most shocking signal of all.

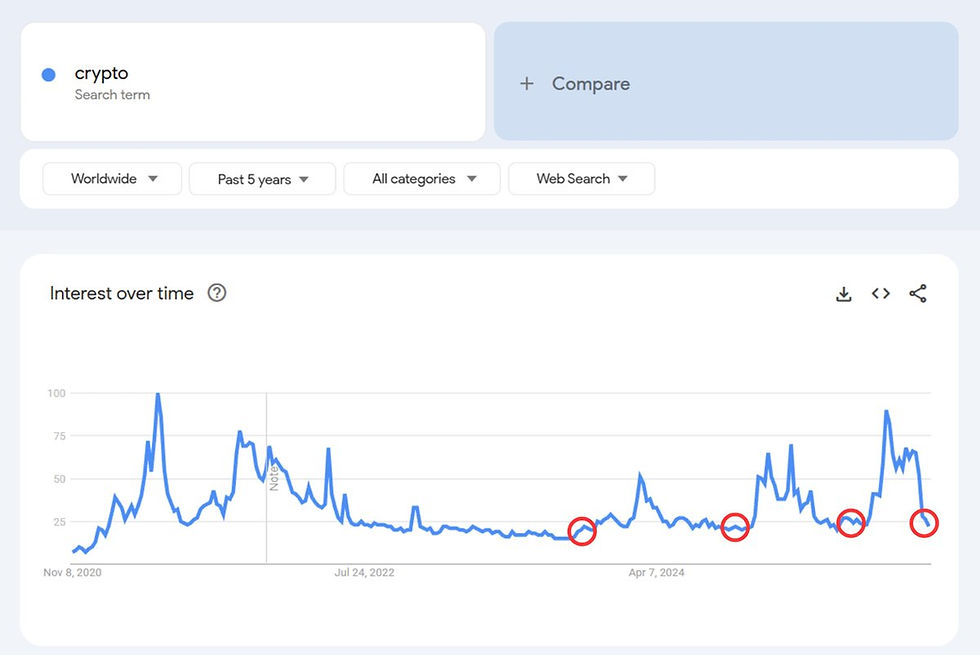

The Crypto Fear & Greed Index is not just at "Extreme Fear"; it's close to the lowest level ever recorded.

Yes, you heard that right—it's even lower than during the absolute bottom of the 2022 bear market during the FTX crash.

At the same time, Google search interest for "Crypto" has flatlined to levels that are, again, historically associated with a market bottom.

And just for good measure, even the "McRib" contrarian buy signal is back.

So, let's sum this up. We have "bear market bottom" levels of extreme fear and retail capitulation, yet the price is holding up far better than it should be. The bull market trend has not been technically broken.

This week is decision time. Will the institutional buyers and contrarian signals win, pushing the weekly close back above $92,929 to resume the bull run? Or will the technical breakdown be confirmed, signaling the bear market has truly begun?

Your Path Forward

We have a stock market at all-time highs fueled by AI hype and retail leverage, a real economy in recession, a banking system holding emergency meetings, and a major institutional shift in Bitcoin.

This is the definition of "signal over noise."

In a market this disconnected, "hope" is not a strategy. A clear, repeatable process is the only way to protect your capital and find peace of mind.

Your next step depends on where you are on your journey:

For Investors at Levels 0-2 (The Saver & Delegator): Your first step is to book a Free Fit Call. We'll discuss your goals and determine if "The Smart Investing Blueprint" is the right next step for you .

For Investors at Levels 3+ (The DIY Learner & Optimizer): You have two paths forward. If you're ready to build your process, you can book "The Smart Investing Blueprint" directly. If you have questions or want to discuss the Options Mastery Accelerator, your best next step is to schedule a Free Fit Call .

Nico de Bony

%20-%20WO%20BG.png)

![[Market Alert] How to Protect Your Portfolio During a Crash Without Selling (Case Study: Silver)](https://static.wixstatic.com/media/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png)

![[Market Alert] The "Red Flag," The Fed’s Secret Call, and The Gold & Silver Trap.](https://static.wixstatic.com/media/e03bc3_368c7875fcc34e69bc9376addd543b34~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_368c7875fcc34e69bc9376addd543b34~mv2.png)

![[Monthly Briefing #3] The "Wile E. Coyote" Economy & Stock Market](https://static.wixstatic.com/media/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png)