[Market Alert] The "Red Flag," The Fed’s Secret Call, and The Gold & Silver Trap.

- Nico DE BONY

.jpg/v1/fill/w_320,h_320/file.jpg)

- Jan 27

- 4 min read

Jan 27th note : Given the urgency of the market data, I am publishing this analysis immediately so you have it tonight. The charts mentioned in the text will be added throughout the day tomorrow.

One crazy week just passed, and another lies ahead.

If you follow mainstream financial news, you are hearing about "new all-time highs" and a resilient economy. But if you look at the data I analyze, the story is very different.

That is why I am sending you this urgent alert: things are moving too fast to wait for the next monthly briefing.

Today, we need to talk about what is really happening behind the scenes: the Fed’s secret call to Japan, the "Sell America" myth, and the specific reason why I sold the majority of my Gold and Silver positions this week.

1. The Fed’s Secret Call (The "Rate Check")

Last Friday, a critical event occurred that was almost invisible to the general public. The New York Fed made a series of phone calls to major banks regarding the Japanese Yen.

They didn't buy anything. They didn't officially intervene (yet). They simply asked for a price. In the industry, this is called a "Rate Check."

It’s the equivalent of a mob boss walking into your shop, looking around, and calmly asking: "How much would it cost to insure all this?" He didn't break anything, he didn't make a direct threat, but the message was received loud and clear.

Why the panic?

Because the Japanese bond market is cracking. We witnessed a "6 Sigma" event (a statistical anomaly that should almost never happen) in Japanese rates.

If Japan loses control of its rates to save its currency, it could trigger a global margin call. The "Yen Carry Trade" (borrowing for free in Japan to invest elsewhere) would reverse brutally, forcing asset liquidations all over the world.

2. Geopolitics: The "Sell America" Myth

With the tensions surrounding Greenland and tariff threats, the media has been waving the specter of the financial nuclear option: Europe dumping its US debt.

Let’s be clear: this is noise.

Look at the capital flows for 2025. Despite the rhetoric, money has not stopped POURING into the United States. If Europe sold its US Treasuries now, it would be an economic suicide pact.

What is much more likely is that we are heading toward a "Plaza Accord 2.0" scenario: a coordinated devaluation of the dollar to relieve pressure, just like in 1985, but managed carefully to avoid a disorderly unwind of the Yen Carry Trade.

3. Gold & Silver: Why I Sold (The Trap)

Here is where I am going against the herd. Gold ($5,100+) and Silver ($106+) have blown past my rational targets. Many are screaming "new paradigm."

As for me? I sold.

I liquidated a large portion of my Silver and Gold positions on Friday and Monday.

Here is why:

Standard Deviation: Silver is 6 standard deviations above its long-term mean. It is a rubber band stretched to the breaking point.

Technical Divergence: While the price is rising, momentum (RSI) is falling. This is the classic sign of a movement running out of gas.

Exhaustion Volume: Volume on the SLV ETF hit historic records yesterday, typical of a "blow-off top."

Investing right now is like picking up pennies in front of a steamroller. I expect a severe correction (-20% to -50%) before the market resets on a healthier foundation. I prefer to secure my gains now.

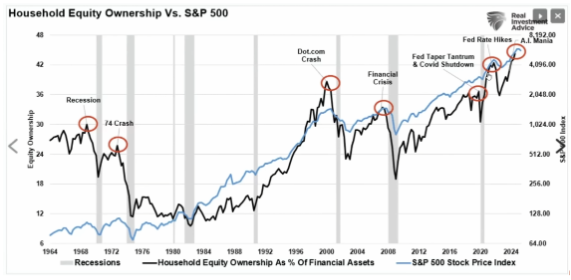

4. Stock Market: The Red Flag is Officially Raised

Since August, I have been updating you on my alert levels for the S&P 500 and Nasdaq:

August: Yellow Flag (Technical cracks).

October: Orange Flag (Momentum stall).

Today: I am raising the Red Flag (Risk > Reward).

The risk/reward ratio is disastrous (approximately 27 to 1 against you). 100% of Wall Street is bullish, which means there is no "marginal buyer" left to push the market higher.

With the FOMC meeting tomorrow and the "Mag 7" earnings (Microsoft, Meta, Apple), we are facing a wall. The slightest disappointment could be the spark that lights the fuse.

5. The Big Picture: Ray Dalio’s Warning

To conclude, I invite you to read Ray Dalio’s latest update [https://www.linkedin.com/pulse/money-civil-international-war-minneapolis-beyondin-ray-dalio-tofee]. According to his historical cycle model, the United States is transitioning from Stage 5 (Intense Internal Conflict) to Stage 6 (Civil War / System Breakdown).

The signs are there: deaths during internal protests, refusal of cooperation between local and federal law enforcement. This context also explains why Gold is rising in the long term: it is not just an inflation hedge; it is insurance against the loss of confidence in the sovereign system.

Conclusion & Feedback

The risks are high, but opportunities exist for those who know how to ignore the noise.

To be completely transparent, I did not have the time to record and edit the English version of this briefing. However, the data is too critical to wait, so I prioritized getting this written analysis to you immediately.

I have a question for you: Is this text-only format valuable to you? Or do you find it harder to digest without the video?

Please send me a message to let me know. Your feedback will help me decide how to handle these tight deadlines in the future.

Thanks,

Nico de Bony

If you found this briefing helpful, feel free to share it. For those ready to build a defensive process, the links to my training are below.

Watch my Free Masterclass to understand the 5 core hedging strategies.

Watch the Practical Demo to see me execute these trades live.

If you want to master this, check out my Self-Paced Course

or apply for one of the few remaining spots in my 1-on-1 Coaching.

Visual supports

Source for next 4 visuals: https://www.youtube.com/watch?v=GeIR-4v7ckw

Source for next 2 visuals: https://www.youtube.com/watch?v=t4fdRIw9rkc

Source for next 4 visuals: https://www.youtube.com/watch?v=f-8h80hQhn4

%20-%20WO%20BG.png)

![[Market Alert] How to Protect Your Portfolio During a Crash Without Selling (Case Study: Silver)](https://static.wixstatic.com/media/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png)

![[Monthly Briefing #3] The "Wile E. Coyote" Economy & Stock Market](https://static.wixstatic.com/media/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png)

![[Market Alert] The Silver Trap: Why the "Ghost Rally" is a Critical Warning Signal](https://static.wixstatic.com/media/e03bc3_14b8c1dd94114198befa4ce731c5c75f~mv2.png/v1/fill/w_980,h_558,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_14b8c1dd94114198befa4ce731c5c75f~mv2.png)