The AI Reality Check: Code Reds, Secret Memos, and the "Cisco Moment"

- Nico DE BONY

.jpg/v1/fill/w_320,h_320/file.jpg)

- Dec 4, 2025

- 6 min read

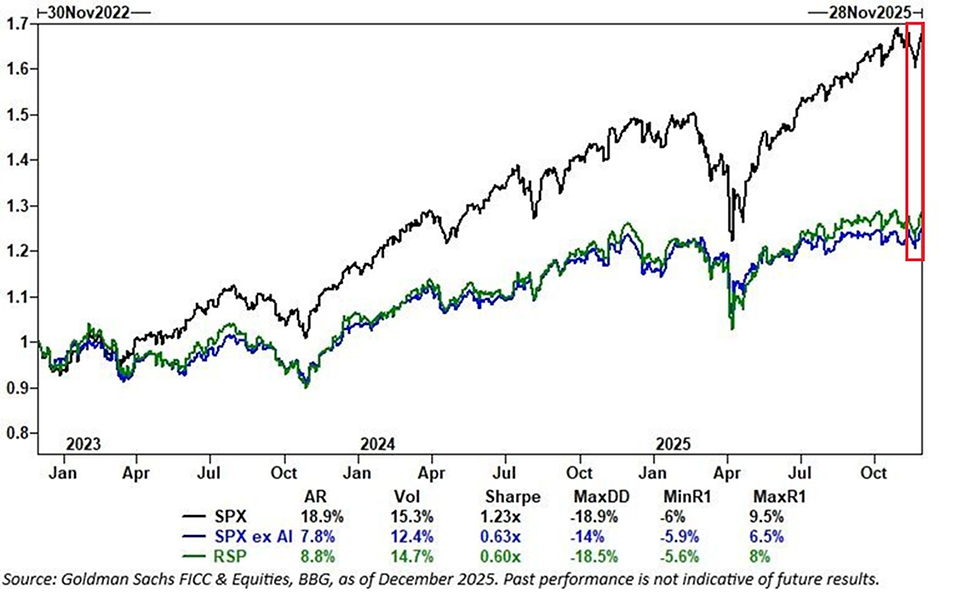

If you only read the headlines, the AI trade seems stronger than ever.

But if you look at what is happening behind the scenes, the narrative has shifted from "Unlimited Growth" to "Crisis Management."

In the last 10 days, we have witnessed a coordinated panic among the biggest players in the industry.

From secret defensive memos to internal "Code Reds," the actions of Nvidia and OpenAI suggest they are preparing for a major shift.

At the same time, the real economy (the one that is supposed to buy all this technology) is flashing recessionary signals that look terrifyingly similar to late 2007.

Here is the deep-dive investigation into the documents, the data, and the economic reality that suggests the "Easy Money" phase is officially over.

1. The Panic Signals: Why Are They So Defensive?

Nvidia’s PR Offensive

Usually, when a company has a monopoly and unlimited demand, they don't waste time arguing with analysts. Yet, this week, Nvidia dispatched a private, 7-page defensive memo to Wall Street.

Why? They felt compelled to explicitly refute analysis by Michael Burry (of The Big Short fame). When a $3.5 Trillion company feels the need to "punch down" and argue with a contrarian investor, it signals insecurity.

To make matters worse, CEO Jensen Huang suddenly appeared on the Joe Rogan Experience podcast.

While the conversation was about technology, the timing is highly suspicious. Going on the world's largest retail megaphone to claim that politicians "saved the AI industry" looks less like confidence and more like a move to secure the retail narrative before a storm.

OpenAI’s "Code Red"

While Nvidia fights the PR war, their biggest customer is fighting for survival. Leaked internal documents reveal that Sam Altman issued a "Code Red" at OpenAI.

The reason is simple: The Moat is gone. Google’s new model (Gemini 3) is beating ChatGPT on performance, cost, and utility. Interest in ChatGPT (according to Google Trends) actually topped out in September, despite the favorable seasonality of students returning to school.

The desperation at OpenAI is becoming visible to the user. They have started rolling out ads within ChatGPT, even for paying "Pro" subscribers. You do not alienate your core paying user base with ads unless you are facing a severe cash crunch and slowing growth.

2. The "Cisco Moment": Why Burry is Likely Right

Nvidia's defensive memo tried to prove they aren't Enron. But they missed the point. Michael Burry clarified that he isn't accusing them of fraud (Enron). He is accusing them of being Cisco.

In 2000, Cisco was a real company selling real routers to real customers. But those customers (Telecom startups) were buying capacity with debt for a demand that never materialized. When the startups went bust, Cisco’s stock fell 82% in 1 year.

The Depreciation Trap

The core of Burry's argument is about "Economic Value" vs. "Useful Life."

Nvidia argues their chips last for years. But in AI, a 2-year-old GPU is like a 10-year-old laptop: it works, but it is economically obsolete compared to the new generation which offers massive leaps in performance and efficiency.

Burry warns that this depreciation is forward-looking. If hyperscalers are using these chips as "inflated assets" to secure billions in debt, and the economic value of that collateral drops to near-zero in 24 months, we are looking at a structure dangerously similar to the 2008 CDO crisis.

The Zoom Warning:

Look at Zoom (ZM). It is a real company with $2 Billion in income today (100x more than in 2020). Yet the stock crashed and never recovered because the valuation was a bubble. This is the exact risk facing Nvidia shareholders today.

3. The Moat Evaporates: The Hardware War

For Nvidia to maintain 70% profit margins, they must remain the only option.

That reality ended this week.

Google's TPUs: Reports confirm that Google's TPUs are now a viable, cost-effective alternative to Nvidia's GPUs.

Amazon's Trainium 3: Amazon just announced its new AI chip, claiming massive cost reductions. The most telling signal? The stock market barely reacted. The hype is fading.

Meta's Pivot: Reports suggest Meta is negotiating to buy Google's chips.

If the biggest customers (Amazon, Google, Meta) start using their own chips to bypass the "Nvidia Tax," Nvidia's pricing power (and those 70% margins) will collapse.

4. The Money Problem: The Math Doesn't Work

The "Genesis Mission" Reality Check

The new Executive Order signed by the White House was hailed as a "Manhattan Project" for AI.

But if you read the details, it is underwhelming:

No massive new funding.

No new infrastructure.

It is simply a reorganization to connect existing national labs and supercomputers to catch up with China and Europe.

It is not the liquidity bailout the market was pricing in.

The "Cost of Goods Sold" Problem

Unlike software (which has near-zero marginal cost), every AI query costs money. A ChatGPT query costs roughly 500x more than a Google search.

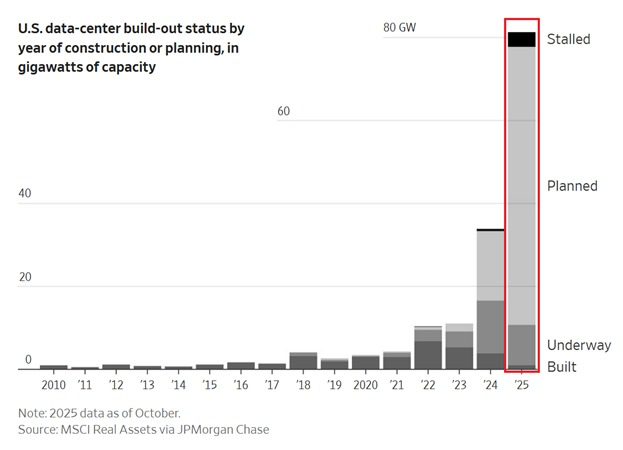

We are hitting a wall where the tech is improving, but the real demand (people willing to pay for it) hasn't materialized to cover these costs. An MIT study from August concluded that 95% of corporate AI pilots are failing.

HSBC estimates OpenAI could face a $207 Billion funding gap by 2030.

If the ROI doesn't appear soon, the "planned" CAPEX spend will vanish, and the bubble bursts.

5. The Economic Disconnect: The Consumer is Tapped Out

For the AI revolution to succeed, a healthy consumer must buy the end products.

But the economic data from this week is disastrous.

The "Real" Black Friday

Don't believe the headlines about record spending.

Dig into the Salesforce data:

Volume is DOWN 1%.

Transactions are DOWN 2%.

Spending is UP only because prices are up 7% (Inflation).

People are buying less stuff for more money, and they are financing it using "Buy Now, Pay Later" services. That is not a strong economy; that is a consumer living on borrowed time.

The Job Market Collapse

The ADP Jobs report for November was a shocker.

Headline: -32,000 jobs.

The Real Story: Small businesses (1-49 employees) lost 120,000 jobs.

This is critical because small businesses are the "canaries in the coal mine." While they make up about 30% of total employment, they historically drive the majority of new job creation. When the engine of job growth throws a rod like this, the recession is usually close behind.

The Challenger Report: A 54% Surge in Layoffs

If the ADP report wasn't enough, the data from Challenger, Gray & Christmas confirms the trend is accelerating.

Don't be fooled by the monthly headline about a lower Month-over-Month.

While November cuts dipped slightly from October, the year-over-year data tells the real story:

November cuts were UP 24% compared to last year.

Year-to-Date cuts are UP 54%, reaching the highest level since the 2020 recession.

But the scariest number isn't the firing; it's the hiring. Companies aren't just cutting staff; they have stopped recruiting.

Hiring announcements have dropped 35% to their lowest level since 2010.

Even worse, seasonal hiring plans are at an all-time low since tracking began in 2012.

When companies stop hiring seasonal workers in November, they aren't expecting a "soft landing." They are battening down the hatches for a recession.

The 2007 Parallel:

US stocks peaked in October 2007. The economy entered a recession in December 2007.

Fast forward to today: The S&P 500 likely peaked in October. Job creation year-to-date is at the same level it was when the Great Financial Crisis started. The AI Super Bubble isn't creating jobs; the data suggests it might be killing them.

The "Smart Money" Playbook: How Institutions Are Positioning

We are witnessing a classic rotation from "Growth at any cost" to "Capital Preservation."

Based on recent flows, here is how institutional money is positioning for this shift using a Barbell Strategy:

Avoiding the Middle: Institutions are de-risking by exiting companies with high debt, high valuations, and no clear path to immediate monetization. The "Infrastructure" trade (chips) is increasingly viewed as a crowded exit.

Looking for Utility: Capital is rotating into "boring" sectors -companies that use AI to cut costs and increase margins (Implementation), rather than the ones building the expensive infrastructure.

The Hedge (Hard Assets): While Tech has been the most sold sector for 6 weeks, flows into Gold and Silver are accelerating. This indicates that major players are hedging against the monetary debasement that will likely be required to keep the system liquid when the deleveraging begins.

The "Buy and Hold" strategy of 2023 appears to be giving way to active risk management.

Hope this helps!

Nico de Bony

OPTI Strategies

%20-%20WO%20BG.png)

![[Market Alert] How to Protect Your Portfolio During a Crash Without Selling (Case Study: Silver)](https://static.wixstatic.com/media/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png)

![[Market Alert] The "Red Flag," The Fed’s Secret Call, and The Gold & Silver Trap.](https://static.wixstatic.com/media/e03bc3_368c7875fcc34e69bc9376addd543b34~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_368c7875fcc34e69bc9376addd543b34~mv2.png)

![[Monthly Briefing #3] The "Wile E. Coyote" Economy & Stock Market](https://static.wixstatic.com/media/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png)