[Monthly Briefing] Why the Fed ‘s Money Printing and the AI Reality Check Are Changing the Game

- Nico DE BONY

.jpg/v1/fill/w_320,h_320/file.jpg)

- Dec 15, 2025

- 25 min read

Updated: Dec 27, 2025

Executive Summary

We are currently witnessing a "Great Disconnect" between optimistic market headlines and a rapidly deteriorating economic reality. While the prevailing narrative calls for a "soft landing" and an invincible AI boom, the hard data reveals a tapped-out consumer and corporate distress reaching 15-year highs.

This structural fragility has forced the Federal Reserve to blink. In a major pivot, the Fed has quietly launched a ~$60 billion per month liquidity injection program ("Not QE") to patch cracks in the banking plumbing, effectively acting as insurance against an economy they can no longer accurately measure due to data voids.

Simultaneously, the AI trade is facing its first true solvency test. The stress in the private credit sector - reminiscent of the early stages of 2008 - is now impacting the financing of AI infrastructure, leading the market to punish "naked" capital expenditures by major players like Oracle and Broadcom. With the equity risk premium now negative, investors are taking maximum risk for zero additional reward, making risk management the priority for 2026.

1. The Economy: The "Hard Data" Reality Check

The popular "Soft Landing" narrative relies entirely on one pillar: the consumer continuing to spend. But the data shows the consumer has hit a wall.

Looking Back (The Trend)

Following the end of the US government shutdown, we received a backlog of economic data that painted a concerning picture. The labor market has shifted gears from a "slow bleed" to a rapid deterioration. Retail sales figures have been consistently disappointing, especially considering we are in a seasonally strong period.

Perhaps most telling was the cancellation of the US GDP release. GDP has largely been propped up by government deficit spending and AI Capital Expenditures (CapEx). When official data is cancelled, it is rarely because the news is too good to share.

New Developments (The Breaking Point)

The cracks are now structural, and we are seeing a clear "K-Shaped" fracture - where the wealthy (Top 10%) are buoyed by asset prices, while the real economy enters a recession.

Corporate Distress: We have seen 717 large US bankruptcies year-to-date, the highest number since 2010. This isn't just small "mom and pop" shops; these are significant players unable to service their debt.

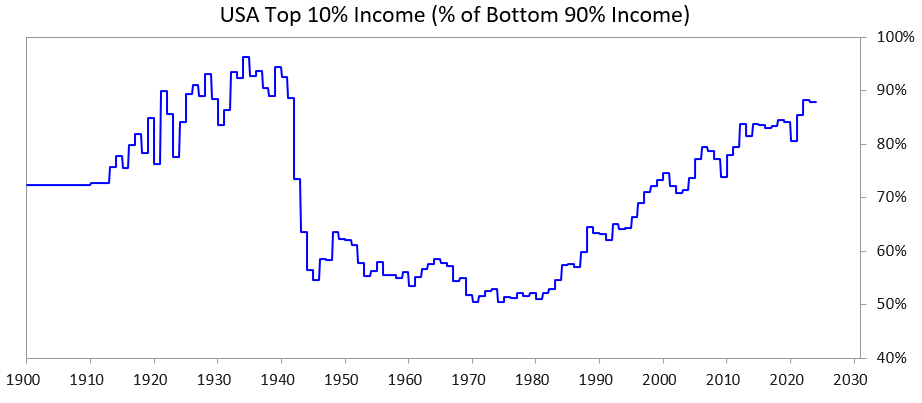

The Wealth Gap Warning: Ray Dalio recently noted that the income share of the top 10% versus the bottom 90% is approaching levels not seen since the start of WWII. Historically, this level of inequality is a precursor to massive internal and external conflict.

Consumer Capitulation: The "resilient consumer" is tapped out. Americans now expect to dial back holiday spending to levels worse than 2008, and the Consumer Sentiment Index has hit an all-time low dating back to 1960.

The "GDP Mirage" Explained:

You might see headlines about "growth," but often this is an accounting quirk. For example, in Canada, Q3 GDP "growth" (0.6%) was driven almost entirely by a collapse in imports. In GDP math, when you import less, the number goes up. But in the real world, importing less means businesses and consumers are too broke to buy foreign goods. It's a "recessionary growth" number.

2. The Federal Reserve: The "Not QE" Pivot

Looking Back (The Trend)

Leading up to the recent FOMC meeting, the Fed maintained a facade of confidence. The Summary of Economic Projections (SEP) painted a rosy picture of controlled inflation and a stable labor market.

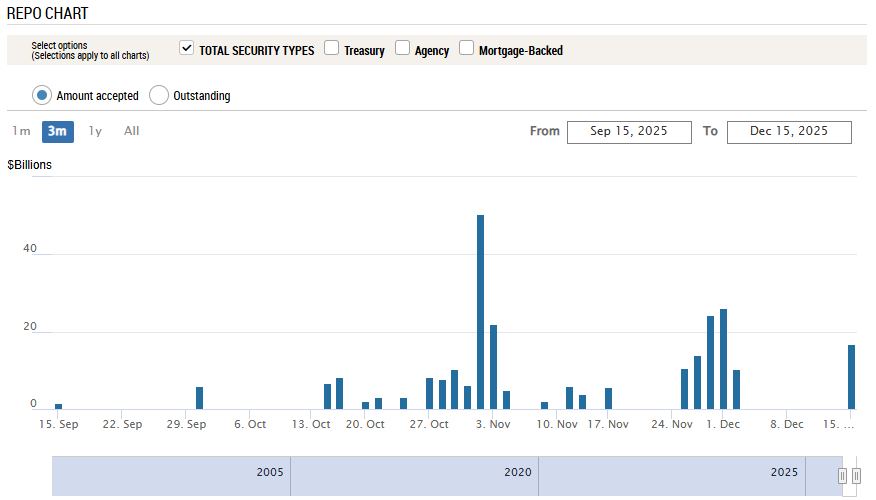

However, behind closed doors, the "plumbing" of the financial system - the cash banks use to operate daily - was drying up.

New Developments (The Critical Shift)

The Fed has blinked.

The "Not QE" Announcement:

In a surprise move, the Fed announced the purchase of up to $40 billion per month in Treasury bills. When combined with the rollover of Mortgage-Backed Securities, this is a ~$60 billion per month liquidity injection.

Why the Debate is Noise: You will hear analysts arguing over whether this is technically Quantitative Easing (QE) or just "Reserve Management." To be technically accurate, traditional QE involves buying long-term bonds to lower long-term rates, whereas this operation buys short-term bills. But this debate is noise.

The Bottom Line: The Fed is printing money to buy assets and injecting liquidity into the system. Call it "QE-Lite" or "Reserve Management," the effect is the same: it is stimulative. It greases the wheels for risk assets and suppresses short-term stress, regardless of the label they slap on it.

The "Higher Plateau" Reality:

Regardless of the label, the trend is undeniable:

The balance sheet is expanding again.

This confirms a historical cycle where every attempt to tighten liquidity eventually breaks something, forcing the Fed to pivot and expand its balance sheet to a new, higher plateau (currently more than 50% above pre-2020 levels). Despite Ben Bernanke’s famous promise to "normalize" the balance sheet over a decade ago, that normalization never arrived. This is currency debasement in slow motion, signaling that the Fed has prioritized short-term financial stability over long-term currency stability. In this environment, scarce assets like Bitcoin and Gold stop looking like a trade and start looking like a lifeboat.

The Silent Admission:

Powell admitted that official job numbers likely overstate growth by 60,000 per month. This implies the US is actually losing 20,000 jobs monthly.

Flying Blind:

The Fed also conceded that upcoming data (inflation and jobs) will be unreliable until January due to the shutdown. They are cutting rates not because the data supports it, but as "insurance" against a reality they can no longer measure accurately.

3. The Banking Crisis: Spreading to the AI Bubble

Looking Back (The Trend)

For months, we have watched cracks appear in the banking sector - from the blowup of "safe" private credit funds to the accelerating use of emergency lending facilities.

The "UBS Funds" vs. "Bear Stearns" Moment:

Recently, two "high-grade" private credit funds managed by UBS blew up. This is eerily similar to June 2007, when two "high-grade" hedge funds at Bear Stearns collapsed. Back then, it was the first domino of the subprime crisis. Today, it signals deep rot in Private Credit - an unregulated shadow banking sector that has grown to over $1.7 trillion.

The stigma of borrowing from the Fed has evaporated because banks are out of options.

New Developments (The Contagion)

The crisis has now intersected with the AI trade, and the parallels to 2008 are becoming impossible to ignore.

The First Brand "DIP" Loan Collapse:

This is a technical but crucial signal. A "DIP" (Debtor-in-Possession) loan is a special loan given to a bankrupt company to keep it running. It is considered the safest loan possible because DIP lenders get paid back before anyone else.On the very first day of the Fed’s "Not QE" operation, the DIP loan for a company called "First Brand" collapsed in value by 60%.

Translation: If the "safest" loan in the room is losing 60% of its value overnight, the risk in the rest of the credit market is catastrophic. This sector finances much of the AI infrastructure buildout.

Oracle Bonds Underwater:

Just a few weeks ago, Oracle issued bonds to fund its massive AI data centers. The sale was reported as a huge success ("oversubscribed," meaning lots of buyers). Today, those bondholders are already underwater - the bonds are worth less than they paid.This marks a shift in the market trend from "slowly" to "suddenly." Investors are realizing that lending money for AI infrastructure carries massive risk if the profits don't materialize immediately.

4. The AI Bubble: From "Build It" to "Prove It"

Looking Back (The Trend)

The past four weeks have been a rollercoaster for the AI narrative. We went from "infinite demand" to serious questions about solvency. We saw reports of circular financing (where tech giants invest in startups that simply use the money to buy chips back from them), Google's Gemini 3 challenging OpenAI's dominance, and a sudden "Code Red" panic at OpenAI. The narrative has shifted from "How fast can we build?" to "How are we actually going to pay for this?"

New Developments (The Reality Check)

For the first time, the market is punishing "naked" spending. Two key earnings reports told two different, but equally bearish, stories:

1. The Oracle (ORCL) Punishment: "Show Me the Money"

For the first time since the AI bubble began, Oracle stock was punished for announcing massive AI spending (CapEx). Previously, saying "we are spending billions on AI" sent stocks soaring. Now, the market looked at Oracle's credit risk (CDS) blowing out - pricing in default risk similar to Lehman Brothers - and asked: "How will you pay this back?"

Oracle is building data centers for OpenAI, funded by debt. If OpenAI cannot become profitable in 2-3 years to pay the rent, Oracle is left with the bill.

2. The Broadcom (AVGO) Punishment: "The Manufactured Beat"

Broadcom reported an earnings "beat," but the stock tumbled. Why? Because smart investors looked under the hood. The "beat" wasn't from selling more AI chips; it was engineered through one-time tax swings and adding back expenses. Real profit margins are contracting. The market is no longer falling for accounting tricks.

Other Critical Signals:

Microsoft (MSFT): Stock dropped instantly after removing internal AI sales quotas - a clear signal that end-user demand is not meeting targets.

China Chip Failure: The "Silicon Tax" proposal (allowing Nvidia to sell chips to China with a fee) backfired within 48 hours. China simply said "no thanks" and accelerated their shift to domestic chips (Huawei). This confirms a permanent technological split - a "Bifurcation" - that cuts US companies off from a massive market.

5. The Stock Market: Euphoria Meets Fragility

Looking Back (The Trend)

Since October 29th, we have been in a topping process.

While the technical patterns are messy, the rotation is undeniable: "smart money" (institutions) is moving out of AI/Tech and into Value and Safe Havens, leaving "dumb money" (retail investors) holding the bag on the dip.

New Developments (The Setup)

Negative Risk Premium: The Equity Risk Premium is now negative.

Translation: Stocks currently offer zero excess return over a risk-free Treasury bond. You are taking maximum risk for no additional reward.

The VIX Signal: The VIX (volatility index) is signaling extreme complacency. This specific technical setup has only happened three times in the last four years. Each time, it led to at least a 10% correction in the S&P 500.

The Opportunity: Low volatility means portfolio insurance is cheap.

Actionable Advice:

If you know how to hedge (buy protection), now is the time. If you don't know how to protect your portfolio, I have resources to help you:

Start Here: Watch my Free Masterclass to understand the 5 core hedging strategies.

See it Done: Watch the Practical Demo to see me execute these trades live.

Learn the Skill:

If you want to master this, check out my Self-Paced Course

or apply for one of the few remaining spots in my 1-on-1 Coaching.

6. Precious Metals & Crypto

Gold & Silver

The bull run continues, driven by geopolitics and the "Not QE" debasement trade.

When the Fed cuts rates into a sticky-inflation environment, it destroys the dollar's value, which is rocket fuel for metals.

Silver: Has confirmed a new breakout.

Did you know? Silver is a "Giffen Good" - meaning demand actually increases as the price rises, because industrial users (like Apple or Tesla) must have it regardless of cost.

Market Manipulation: We saw suspicious trading halts at the CME during the night between Nov 13th and Nov 14th, reminiscent of tactics used in 1980 (margin hikes, position limits) to suppress price spikes. Be aware that the game is rigged, but the physical shortage is real.

Bitcoin

We may see a rebound toward $100k, but the asset remains fragile.

Key Levels: Holding above the "True Market Mean" is essential.

Short Term: If the broad stock market drops (my base case), Bitcoin will likely correlate to the downside before decoupling.

Institutions: Watch for MSTR (MicroStrategy). Michael Saylor hinted they might sell BTC if their valuation drops too low - a potential headwind.

7. Looking Forward: The Month Ahead

We are entering a period of high volatility potential.

December:

Data Avalanche: We are waiting on a flood of delayed economic data.

Triple Witching (Dec 19): A massive options expiration date that could trigger volatility.

BoJ Wildcard: The Bank of Japan is likely to hike rates. This could accelerate the unwind of the Yen Carry Trade, pulling liquidity out of global markets.

Holiday Volume: Light trading volume during the holidays often exacerbates price swings.

Santa Claus Rally? Do not expect a calm or guaranteed "Santa Claus Rally." Seasonality typically works in "normal" years, but 2025 has been exceptional. The fuel for a year-end rally usually comes from the recovery of a "Sell in May" pullback. Since we have had a non-stop trend since the April lows, the market is currently extended and exhausted, leaving little gas in the tank for a traditional year-end pump.

January:

Supreme Court: A decision on tariffs is pending.

Data Catch-up: Delayed GDP, Retail Sales, and Jobs data will finally hit the tape.

Central Banks: Decisions from the BoJ (Jan 22), FOMC, and BoC (Jan 28) will set the tone for 2026.

Final Thought

The Fed is trying to patch the cracks with "Not QE," but they cannot fix the solvency issues in the real economy. The disconnect between stock prices and economic reality is at a historical extreme.

Invest smart, not hard - and prioritize protection over greed.

If you found this briefing helpful, feel free to share it. For those ready to build a defensive process, the links to my training are below.

Watch my Free Masterclass to understand the 5 core hedging strategies.

Watch the Practical Demo to see me execute these trades live.

If you want to master this, check out my Self-Paced Course

or apply for one of the few remaining spots in my 1-on-1 Coaching.

Nico de Bony

Video Transcript

0:00

Welcome to the monthly briefing

0:01

number two.

0:02

It's for people who don't have much

0:03

time to look at what's happening

0:04

in the economy and the stock market.

0:06

I'll cover what has been happening for

0:08

the past month since my last report.

0:10

I'll focus more on the things that

0:12

happened in the past week, 'cause

0:12

I haven't done an update on this.

0:14

we'll cover the US economy, the

0:16

banking crisis, the AI bubble, the

0:18

stock market, and what it means for

0:19

your portfolio.

0:20

So let's get started

0:21

and everything will be in the blog

0:23

with a link in the description if you

0:24

want to check it out for yourself.

0:25

the economy in the past few weeks,

0:27

the, hard data has continued to

0:29

worsen and the soft data as well.

0:31

And here was just the retail sales to

0:33

show you how, it's been mostly flat.

0:35

So basically the soft lending

0:36

narrative that the Fed has been

0:37

pushing, the government has

0:39

been pushing a bit and medias have

0:40

been pushing it's not gonna happen.

0:42

looking back also, the GDP cancellation

0:44

now I think we know why, because of

0:46

the data published this morning.

0:48

the job market, and retail sales, it

0:50

looks really bad.

0:51

So the GDP data will probably

0:52

be, really bad.

0:53

It will be published in January, with

0:55

the final numbers.

0:56

So we'll see then what happens.

0:58

In terms of the new development,

0:59

the, k ship economy is really

1:01

getting worse.

1:02

Like it's diverging more and more.

1:04

and right now it's not only affecting

1:05

small business anymore, it's really

1:07

affecting large companies as well.

1:08

They have trouble paying

1:09

back the debt.

1:10

And so that's, really something

1:11

because the number is the highest

1:13

since 2010.

1:14

So think about the 2009,

1:16

financial crisis.

1:17

and we're, reaching levels that we

1:20

are less since, After the recession

1:22

already started, so for two years I

1:25

was talking about the wealth gap.

1:26

Here's a chart from Ray Dalio.

1:27

You can click here and get

1:28

to the article.

1:29

But basically saying that when you get

1:31

such a divergence, usually you get

1:33

the internal and external conflict.

1:35

And the last time was this high was

1:36

just before World War II, and this is

1:39

just the index of consumer sentiment

1:40

showing you that the data going

1:42

back to 1960, it's the lowest ever.

1:44

I just put a quick thing here

1:46

about the GDP.

1:46

Sometimes there's a mirage.

1:48

here's a quick example.

1:49

For Canada, it would apply to

1:50

any country, but basically

1:51

for Q3, they published a GDP.

1:54

That was positive, but it was only

1:55

positive because of accounting

1:56

the imports going down, which is a

1:59

really bad sign, not a good sign.

2:00

And so without the imports going

2:02

down, it would've been negative.

2:03

It would've been a technical recession.

2:05

Let's get to the Fed.

2:06

So just looking back, the three

2:07

weeks leading to the Fed.

2:08

So they were basically saying,

2:10

that, it was fine and maybe there

2:12

would be a need for cut and for a

2:14

while that was the market consensus.

2:16

But then they completely changed.

2:17

And something else that was

2:19

happening in the background, was

2:20

the banking crisis.

2:21

So we saw the REPO chart showing.

2:23

when people go to the Fed, like banks

2:25

to borrow because they're the lender

2:27

of last resort and only resort,

2:29

and it means every single time that

2:31

no single bank was willing to lend

2:33

to another bank.

2:33

At any rate, that's really bad.

2:35

And this is a graphic from this

2:36

morning, so December 16, just to show

2:39

you that despite the Fed ending "QT", so

2:42

money destruction on the December 1st and

2:45

starting to print with QE or QE-Light,

2:48

since then.

2:49

There have still been two instances

2:51

where banks were forced to go to

2:53

the Fed, and even yesterday they went

2:55

to the Fed despite everything that's

2:57

been happening.

2:57

So it really shows you that even though

2:59

they say we have the tools and everything

3:01

is under control, clearly it's not in

3:03

terms of the new, thing that happened.

3:05

in the past few weeks, in the past

3:07

week, the money pre we started

3:08

and, there have been several

3:09

annoucements.

3:10

So first during

3:11

The press conference, people

3:13

were expecting a cut, but they were

3:14

expecting a hawkish cut, meaning the

3:16

Fed would actually say, we are done.

3:19

You know, for now there's no forward

3:20

guidance for it.

3:21

it's just a risk management thing.

3:23

But they actually said a few things

3:24

that surprised the market.

3:26

First one was that they announced that

3:28

they would start printing 40 billions

3:30

per month with no end date in site.

3:32

And that's in addition to the

3:33

20 billion they had announced at

3:35

the previous one.

3:35

So that's a total of 60 billion

3:37

per month.

3:38

of added liquidity to the market.

3:39

So you can see how quickly they switch

3:41

from destructing money to printing

3:43

money again, and I know it's not

3:44

technically qe, but you don't

3:46

need to focus on the definition.

3:49

The thing is, it's liquidity injection

3:51

in the system.

3:51

It always starts with Lite-QE, like

3:53

this, but eventually they have to do real

3:56

QE and buy bonds.

3:57

And this goes into the real economy.

3:59

And the other thing is that, this is

4:00

the balance sheet.

4:01

I'm sure you saw it before of the Fed.

4:03

And every time they have to go up, they

4:05

try to go down, but they can never go

4:07

back down to the level it was before.

4:08

And so that's why the plateau is

4:10

always going up.

4:11

Ben Bernanke famously said that

4:13

they would normalize the balance sheet,

4:15

meaning they would go down to the

4:16

level they initially started at.

4:18

And you can see here we are more

4:20

than 50% higher than when they

4:21

started 2020 in the last round of QE.

4:24

And they are about to go up very

4:26

quickly again, so it, it's just

4:28

something they can never do basically.

4:30

The other important thing from that

4:31

press conference was Powell admitted

4:33

that the BLS data since April is

4:35

probably overstating the average number

4:38

of job created per month by 60,000, and

4:40

since the average right now is about

4:42

40,000 per month, that turned into

4:44

a negative 20,000

4:45

Per month.

4:45

at least since April.

4:47

And you know, it could be much worse.

4:48

This is just the Fed saying what

4:50

they think it is, but they are

4:52

always optimistic.

4:53

So you have to take this with

4:54

a grain of salt.

4:55

And the other thing that's interesting

4:57

is they've been always saying

4:58

that they are data dependent.

5:00

Meaning they don't make a decision

5:02

unless they have hard data to back

5:03

it up because they don't want to rely

5:05

on anything else yet here they are

5:06

taking, again, a decision to cut

5:08

and the decision to print money.

5:10

But they say that they don't have

5:11

any data, and the data that will be

5:13

coming in the next few weeks will

5:14

likely be unreliable because of the

5:16

government shutdown.

5:17

So you can see how they, keep changing

5:20

the narrative and the justification

5:21

to suit whatever message they

5:23

want to push.

5:24

But really they're flying blind

5:25

and they have no clue what they're

5:26

doing and they're always late.

5:28

And so it's gonna be really bad, I think.

5:30

and that's why they will likely

5:31

be forced to do an emergency cut

5:32

by the end of January because.

5:34

Eventually they won't be able to

5:36

avoid, acknowledging the situation

5:38

for what it is.

5:39

Now let's go to the banking crisis,

5:41

which is related.

5:42

So first I wanted to, a brief

5:43

look back in the past few weeks.

5:45

I'm not sure exactly the date, but

5:46

basically we had two high grade UBS

5:48

private credit funds that blowed up.

5:50

And this was something that

5:51

reminded me of what happened in 2007

5:53

with Bear Stearns.

5:54

So in June, 2007, they had also

5:56

two high grade.

5:57

Private credit fund that collapsed and

5:58

it was the canary in the coal mine for

6:00

what ended up being the 2008 global

6:02

financial crisis.

6:03

remember those high grade funds

6:04

are supposed to be really safe.

6:06

And so when people rush for the exit

6:07

and ask to withdraw their money all

6:09

at once, that's not a good sign.

6:12

And the important thing about

6:12

the private credit is that,

6:14

It's

6:15

really a massive and growing market, and

6:17

it's related to ai.

6:18

I'll talk about, next, but first

6:19

I wanted to talk to you about

6:21

first brand.

6:21

It's a company that was bankrupt.

6:23

It's not in ai, but it's really

6:24

probably the canary in the coal mine

6:26

for the credit market as well,

6:28

because when they went bankrupt, they

6:30

got a loan that's called "DIP" Loan,

6:32

and so that's a debtor in possession

6:34

basically.

6:34

It's one of the safest loan

6:35

you can get.

6:36

You, you can give as a lender, because

6:39

since 1988, based on my research,

6:41

it only happened once that a lender

6:44

didn't get 100% of their money back.

6:46

All the others they always get

6:47

their money back because they get in

6:48

front of the line.

6:49

So whatever the company going

6:51

bankrupt does, in the end,

6:53

they have to pay this loan first.

6:54

This loan on the first day where

6:56

the Fed is already starting to print

6:58

money lost 60% of its value overnight.

7:01

So that shows you how if the safest

7:03

loan can lose money so quickly and the

7:05

value collapse, what happens to the rest

7:07

of the collateral in the private

7:09

credit market.

7:10

So that's really scary.

7:12

Something else or so that, is showing

7:13

you how it can related to AI a bit

7:15

Is Oracle their, credit default swap.

7:18

the interest rate, for people who want

7:19

to protect against a default of Oracle

7:21

is exploding and reaching a level

7:23

less during the financial crisis.

7:25

And also based on my research, it's at

7:27

the level of Lehman Brothers in 2008.

7:30

Just to give you an idea of how

7:31

the AI bubble and the credit private

7:34

credit market are colliding So,

7:36

briefly for people who haven't been

7:38

paying attention for the past,

7:39

four weeks, the AI really, narrative

7:42

has completely changed in terms

7:43

of what the market wants and perceive,

7:45

especially when it comes to the

7:46

stock market.

7:47

And so it used to be that they

7:48

could announce AI CapEx and

7:50

everything was fine.

7:51

The stock market would reward them.

7:52

Now it completely shifted.

7:54

Now people are like.

7:55

does this make sense?

7:56

Can you make money from this?

7:57

They're looking for return investment,

7:59

not just a blank check, basically.

8:01

And so this is gonna be interesting

8:03

because, the recent announcements,

8:05

from Oracle and Broadcom, a perfect

8:07

example of this.

8:08

when Oracle published their

8:09

earnings, so it was after the Fed.

8:11

They're stock tumbled despite

8:12

announcing CapEx like in the past.

8:14

And other were also affected

8:16

when, Oracle, you know, tumbled.

8:18

basically people were like, oh,

8:20

you are taking on more debt,

8:22

yet your biggest client open AI has

8:24

to be profitable within two, three

8:25

years to pay you back so you can

8:27

profit from this.

8:29

And so you probably will be holding

8:30

the bag at the end.

8:31

And you know, even in the best case

8:33

scenario, open AI is not projected

8:34

to be profitable.

8:35

before 2032 or something like this.

8:37

So this is something that was kind of

8:39

scaring investor.

8:40

Something else, Broadcom,

8:41

they published earning beat.

8:43

You know, if you look on the surface,

8:44

it looks great.

8:45

The people actually look, and it's

8:46

not because of ai, it's not because

8:48

of sales, it's not because of

8:49

good things, it's just because of

8:50

accounting things they changed.

8:52

And so, again, you know, when you

8:53

look beneath the surface, because

8:55

the euphoria around AI is starting to

8:57

fade, especially for people looking

8:59

deeper, not people just buying

9:00

without thinking.

9:01

it's really changing things around.

9:04

Two other things I wanted to mention

9:05

first, Microsoft, it was leaked that

9:07

they are canceling the sales quota

9:09

for anything related to ai.

9:11

So, of course, their stock, was

9:12

penalized when this was announced.

9:14

And it shows you how people are

9:16

not interested in buying the solution

9:18

from Microsoft, especially

9:19

businesses.

9:20

And so this is really

9:21

affecting them.

9:22

And so instead of just missing

9:23

their sales quotas for AI, they just

9:25

cancelled it at And I kept the best

9:27

for last for AI.

9:28

for, a few years, the, US has been

9:30

banning, Nvidia and other, big

9:32

players to sell GPUs to China.

9:33

Of course, China has been able

9:35

to get some, by going around but.

9:37

finally the US government says,

9:38

okay, we will allow you to sell the GPUs

9:40

to China, but we'll get a tariff on it.

9:42

And China basically says, no thank you

9:44

within 48 hours.

9:45

So that shows you how China is not

9:48

willing to depend on the US and want

9:50

to develop their own architecture,

9:52

which is a big bifurcation, for the

9:54

way they develop ai.

9:55

Now, let's look at the stock market

9:57

and the impact of all this.

9:59

So first, if you look back, on

10:01

October 29th,

10:01

I told you that it was gonna be the

10:03

either the top or the start of the

10:05

topping process.

10:06

so it looks like a topping process,

10:08

a bit messy, like the end of 2024

10:10

and early 2025.

10:11

the one thing that's interesting to see

10:13

is that there's really a rotation,

10:15

from smart money to Dumb Money, you

10:17

know, investors.

10:19

And you can see on this chart

10:20

the, confidence.

10:21

So it's.

10:22

near all time has for do return

10:23

investors, and it's, quite low

10:25

for the smart money institutional.

10:27

And so one of the reasons why you

10:29

haven't seen a real crash yet is

10:30

because they're not selling everything.

10:32

They're rotating.

10:33

So from tech and AI to value

10:35

and safe haven.

10:36

And so that's kind of why the stock

10:37

market has been in that pattern,

10:39

like, the end of last year.

10:41

But basically once they're done

10:42

with this and they might start to

10:44

want to raise cash, it might trigger

10:45

the real crash.

10:47

Something that's also interesting if

10:48

you're investing in the stock market is

10:50

that, recently the risk premium has

10:52

turned negative.

10:53

So it means that it's riskier to

10:55

invest in the stock market than to just

10:58

take A-A-A-T-B-L or something where

11:00

you're guaranteed your capital and

11:02

interest on it.

11:03

And so that's really bad because usually

11:04

when you get this, people pull back

11:06

money from the stock market and then it's

11:07

a vicious circle.

11:09

The big signal also the, fear index

11:11

And right now it's extremely low.

11:13

It signals complacency, and

11:15

this usually happens before big moves.

11:17

You can see, every time there

11:18

was a spike.

11:19

Just before the spike, it was a low.

11:20

in the past four years,

11:21

especially, every time the current

11:23

configuration happened, there

11:24

was a, at least 10% pullback

11:26

or correction on the S&P500.

11:28

So you can do whatever you

11:29

want with this information, but

11:31

it's just, to give you an idea

11:32

of there are so many indicators

11:34

pointing in the same direction.

11:36

And I thought that this picture

11:37

illustrated well, the, opportunity

11:38

right now, you know, investors are

11:40

so complacent that portfolio insurance

11:42

is really cheap.

11:43

And so if you're interested in

11:44

this and know how to do it,

11:46

it's a good time.

11:46

It's not financial adice, but just

11:48

I'm sharing with you what, I'm

11:49

seeing and doing.

11:50

And so if you want to actually do

11:52

it, here are a few ways you could.

11:53

So if you haven't already watched, I

11:55

have a free master class where I share

11:57

five, strategies including this one.

12:00

If you, see it and you're interested,

12:01

but you don't know how to do

12:02

it and you're not sure if it's too

12:03

complicated, I even recorded demo where

12:05

I share my screen to show you how easy

12:07

it is to buy and sell those products.

12:09

So you can click here if you want

12:10

to see the demo and if you want

12:11

my help, there are two ways to do it.

12:12

So right now there's a self-based course

12:14

you could take on, put options.

12:16

It's really complete.

12:16

It should give you everything you need

12:18

so you can do it on your own if you

12:19

feel confident.

12:20

And if you are not confident doing

12:22

it on your own, you could apply

12:23

for one of my, remaining spots

12:24

for the one-on-one coaching as well.

12:26

So now, briefly I wanted to mention

12:27

some things about precious metals

12:29

and crypto.

12:30

'cause I keep getting questions,

12:31

So basically, since the last

12:33

month, there hasn't been many change.

12:35

I mean, you know, gold and silver

12:36

continuity option that I talked

12:37

about and Bitcoin has been, in that

12:40

rebound that I talked about.

12:41

But likely, we'll start the,

12:43

downtrend to finish the move, soon.

12:45

The one thing I wanted to mention

12:47

though about silver, because, I thought

12:49

it was interesting.

12:49

In the past month, in the night of

12:51

November 13th to 14th, there was a

12:54

trading halt for about 10 to 12 hours

12:56

officially because the servers needed

12:58

cooling in practice.

13:00

This is the kind of thing that happened

13:01

when the dealers are in panic mode

13:03

and try to, Stop the bleeding basically

13:06

of a short squeeze on silver, just like

13:08

in the eighties.

13:09

And so I have people who are really

13:10

knowledgeable in that area, who've

13:11

been, sharing info with me about this.

13:13

But yeah, basically something shady is

13:15

happening in the silver market and

13:16

we could potentially be seeing a short

13:18

squeeze by the end of January.

13:20

So something to keep watching.

13:21

same thing for gold in a way

13:23

because once, you know, one of them

13:24

takes off, usually attracts people

13:26

And the other thing I discovered

13:27

in the past week or I learned.

13:29

Was that silver is a "Giffen" good.

13:31

It means that actually when the

13:33

price increase, the demand increases

13:35

because some companies, they

13:36

don't have a choice.

13:37

If they don't buy silver.

13:38

If don't have enough silver for

13:39

production, like for electronics,

13:41

think Apple, Tesla, and all those

13:43

companies, well they, they would

13:44

stop production.

13:45

They would stop revenue.

13:46

It would be like the end of the

13:47

world for those companies and so.

13:49

The more the price goes up,

13:50

the more they need to reserve stock.

13:51

And sometimes they even go to the

13:52

miners themselves to try to reserve

13:54

some stocks, and therefore,

13:55

of course, it's pushing the price

13:56

of silver up.

13:57

So something to keep in mind because it

13:59

could really, be the perfect storm for

14:01

that silver squeeze.

14:03

Now let's look briefly at what's

14:04

gonna happen over the next, six to

14:05

eight weeks, because there's gonna be

14:07

a lot of things.

14:08

for December, the data avalanche of

14:10

the post government shutdown already

14:11

started, this week, especially this

14:12

morning with the non-farm payroll.

14:14

I won't talk about it in this

14:15

video 'cause I'll talk in next one.

14:17

But basically it's, it was really bad.

14:19

There will be more data coming on.

14:21

this week will be particularly

14:22

important for Friday because it's a

14:24

triple expiration.

14:25

You have expression for options and

14:27

features for the weekly, monthly,

14:28

and quarterly.

14:29

And so that can add a lot of,

14:31

volatility just on a normal day.

14:32

But on that day, there's the Bank

14:34

of Japan wildcard.

14:36

They could be hiking again.

14:37

That's what is the base case right

14:39

And if they do, that could really,

14:41

exacerbate the whole thing because

14:43

it would pull out liquidity from

14:44

global markets.

14:45

And so then it's a vicious circle.

14:46

So we'll see how it goes, but I

14:48

think a lot of people are gonna

14:49

sell ahead of it.

14:50

And so the sell-off could actually

14:51

start on Thursday.

14:53

Lastly, the volume is likely gonna

14:54

be low, which can affect volatility

14:56

of course, 'cause it doesn't take

14:57

as much money to move the price.

14:59

And the Santa Claus rally, I think, is

15:01

gonna be canceled just because, the

15:02

market is running on fumes and

15:04

there was no pause between April and

15:06

now basically.

15:07

So, I don't think there's enough juice

15:09

in there and good news to keep it up.

15:11

But we'll see.

15:12

it's still possible.

15:13

January is gonna be, the make a make

15:15

or break basically for the market.

15:17

First there will be the Supreme

15:18

Court decision regarding the

15:19

tariffs for the US.

15:20

And so regardless of what happens,

15:22

I think there's gonna be a lot of

15:23

volatility because they will create

15:24

uncertainty.

15:25

'cause if the tariffs are

15:26

approved, maybe, you know, they can

15:28

be increased or you know, some companies

15:30

were hoping for the tariffs to

15:32

be reversed and to be reimbursed.

15:34

it's gonna be really bad and their

15:35

earnings will show.

15:36

And if it's rejected by Supreme Court,

15:38

I'm sure the government will try

15:40

to find another way to get the tariffs

15:42

going again, and so one way or the

15:44

other, I think it's gonna be a big

15:46

catalyst pushing the market down the

15:47

global uncertainty down or up

15:50

It's gonna be a lot of more data

15:52

that the Fed will be looking at

15:53

and other central banks as well.

15:55

And there will be a. decision by the

15:58

Bank of Japan and the Fed and the

16:00

Bank of Canada, So it's gonna be

16:01

a busy month in terms of, key data

16:04

that, again, has all the potential

16:06

to trigger, a severe crash or, you know,

16:09

regular correction.

16:10

But a reset is needed either way.

16:12

Way.

16:12

Lastly, I wanted to finish this video by

16:15

telling you that the most important thing

16:16

in this kind of environment, based

16:18

on my experience, is not to try to get

16:20

the less squeeze of the lemon, a little

16:22

bit more profit before cashing

16:24

out for the year.

16:25

it's really about protecting the

16:26

capital so you don't have to try

16:28

to get your money back if you lose

16:29

a lot of money.

16:30

if you found this video or this

16:31

blog or these resources useful,

16:33

feel free to share it with someone

16:35

you know, could benefit from it.

16:36

If you have any questions related

16:38

to this video or the blog post,

16:39

please put it under the video.

16:40

I'll do my best to answer it and, I

16:42

hope you found this useful and I'll see

16:43

you on the next one.

%20-%20WO%20BG.png)

![[Market Alert] How to Protect Your Portfolio During a Crash Without Selling (Case Study: Silver)](https://static.wixstatic.com/media/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_9308ee513ef54bc2a1627b8ff9c9edf7~mv2.png)

![[Market Alert] The "Red Flag," The Fed’s Secret Call, and The Gold & Silver Trap.](https://static.wixstatic.com/media/e03bc3_368c7875fcc34e69bc9376addd543b34~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_368c7875fcc34e69bc9376addd543b34~mv2.png)

![[Monthly Briefing #3] The "Wile E. Coyote" Economy & Stock Market](https://static.wixstatic.com/media/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png/v1/fill/w_980,h_529,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e03bc3_20ffe9c5479f4eb7a3ba09e2b0b0a218~mv2.png)